is a car an asset or expense

It leased it - the clue is in the name. Vehicles are assets but after reading this answer you may want to delete those vehicles you entered as assets.

Is My Car An Asset Or A Liability Moneyunder30

These are also the costs expenses of owning a car and while not necessarily.

. Usually decreases in value over time. Assets include properties of all kinds that provide some value to a business in the future. Many people could buy property with what they.

Its balance sheet value has nothing whatever to do with any outstanding loan to finance it. There is no definitive answer as to whether a car is an asset or a liability. As both assets and expenses are incurred when you buy goods or services for your business its easy to assume that theyre the same thing.

Additionally fixed assets are generally thought be items that are new or replacement in nature rather. Ongoing ownership costs include maintenance leaseloan payments gas and insurance. Typically an item is not considered to be an asset to be capitalized unless it has a useful life of at least one year.

However cars fall into a special category of assets called depreciating assets. The obvious basic reason why a car is not an asset is that it depreciates in value while at the same time removing money from your pocket. Owning a car generates a certain amount of expenses and accountabilities as time goes by.

3000 500 1500 5000. Your car is loosing value every day that you are driving it and at the same time eating into your wallet to maintain it in terms of fuel service insurance etc. If it is an operating lease then it is a revenue expense and the asset.

June 3 2019 102 PM. If its an old car there is no depreciation write-off. Imagine you purchased a car for 1000000 and by the end of the week you decide that you dont like the car or another pressing issue arises for the use of the money.

Answer 1 of 57. The value continues on this downward trajectory for the rest of the lifespan of the car. Your total mileage was 18000 and documented business miles were 16200.

If the lease is a finace lease then it is accounted for as a loan and the asset capitalised. A depreciating asset is an item that loses value over time. Semantics aside if it was a finance lease then it should already have been capitalised.

The company did not buy the car via a finance lease. On the one hand an asset. Fixed assets are usually expensive in nature and do not include inventory for resale or repair or spare parts inventory.

Because your car is an asset include it in your net worth calculation. Accounting for this as a liability is. Is a resource owned by your business.

A car is an asset to its owner because it took money to buy the vehicle. Maintenance cost repair cost mortgagelease payment car insurance down to car parking and toll fees are all included in the cost of owning a private vehicle. The most you can command for your one-week old purchase is 900000.

In comparison an expense is the amount of resources that have already been consumed in the operations of a business during an accounting period. Even with all that in mind a car is an asset because you can quickly put it on the market and convert it to cash albeit for less than what you. On the other hand if what you owe is less than what your car is worth it would be considered an asset.

Asset is a resource available to a business that gives it some form of economic benefit in the future. If you have a car loan include it as a liability in your net worth calculation. Even though your car maybe a positive asset it does generate a number of expenses and liabilities over time which is the reason why a lot of people classify a car as a liability.

Generally the Modified Accelerated Cost Recovery System MACRS is the only depreciation method that can be used by car owners to depreciate any car placed in. To keep your net worth accurate however you must. If you have any other details regarding this question please feel free to post them in the comment section.

The 300 printer is an expense. You may be referring to the Actual Expenses method of deducting your car for work. So for example if your car is worth 10000 and you have an auto loan for 20000 to pay off your car would be considered a liability.

However theyre actually quite different. Cars can start to lose value as soon as you drive them off the lot. Other car expenses for parking fees and tolls attributable to business use are separately deductible whether you use the standard mileage rate or actual expenses.

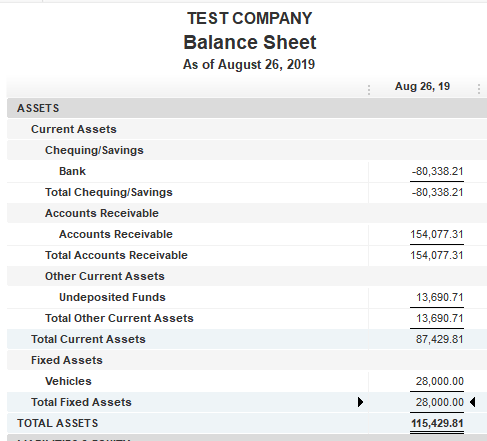

A car is an asset and is shown in a balance sheet at a value of cost minus accumulated depreciation. The car is an asset since it is something that has value. This is one of the reason why many classify a car as a liability rather than an asset.

If you use the actual expenses method you could deduct 4500 90 of 5000. 09 x 100 90 business use. The business-use percentage is 90.

Cars can start to lose value as soon as you drive them off the lot. Generally your net worth calculation should include all your valuables such as vehicles real property and personal property like jewelry. Your total actual expenses were 5000.

Helps your business produce goods or provide services. In some cases your car could lose up to 20 of its value the second you drive.

Is A Car An Asset What You Need To Know Clever Girl Finance

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy In 2022 Balance Sheet Check And Balance Debt To Equity Ratio

Managing Your Money Financial Statements Made Simple Assets Vs Liabilities Personal Financial Statement Income Statement Cash Flow Statement

Professional Company Car Allowance Policy Template Policy Template Templates Policies

Is Your Car An Asset Or A Liability

Personal Finance Spreadsheet Bundle Google Sheets Etsy Espana Personal Finance Emergency Fund Finance

Accounting Basics Purchase Of Assets Accountingcoach

How Do I Remove A Fixed Asset An Old Vehicle That

Is A Car An Asset Or A Liability Beating Broke

Is Your Car An Asset Or A Liability

Is Your Car An Asset Or A Liability

Tips For Maintaining Your Company Car For Expense Control And Safety Car Dealer Car Lease Car Finance

Is My Car An Asset Or A Liability Moneyunder30

Is A Financed Vehicle An Asset Mediation Advantage

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Balance Sheet Excel Spreadsheets Restaurant Business Plan

Monthly Cash Flow Forecast Model Guide And Examples Cash Flow Cash Flow Statement Financial Analysis

/Familybuyingnewcar_skynesher_CROPPED_Eplus_Getty-2a8c993cd0c146da9cdcd5c293f766b2.jpg)